Media Contact:

Katie Peters

D: +1 602 735 5249

M: +1 303 968 5801

Katie.Peters@cbre.com

PHX East Valley (September 1, 2015) – Businesses looking for office space in the nation’s hottest tech markets should expect to pay a premium – and a hefty one in many of the top tech cities, according to a new research report by CBRE Group, Inc. The report, which analyzes the top 30 tech cities across the U.S. and Canada, showed an aggregate rent premium of 11 percent across all 30 markets. And while the numbers may have tech tenants in some markets cringing, companies located in or looking at metropolitan Phoenix should feel pretty good about two areas in particular: job growth momentum and rental rate growth.

Metropolitan Phoenix posted a two-year growth rate of 42.7 percent for high-tech services/software-centric jobs from 2012 to 2014. This translates to 12,662 new tech jobs added to the market over the two-year period. These jobs comprised 31.3 percent of overall new jobs added to the Valley’s office base. Comparatively, San Francisco also saw a high-tech services/software job growth rate of 42.7 percent from 2012 to 2014, which was 55.1 percent of that market’s overall office-job base. San Francisco’s actual number of new jobs in that time frame was 16,976.

In Phoenix, major high-tech leasing activity exceeded 1.0 million sq. ft. over the past two years; 40% was transacted through Q2 2015, making the current year tech companies’ most active yet in the metropolitan area. Tech firms employed 42,304 people Valley-wide at the end of 2014.

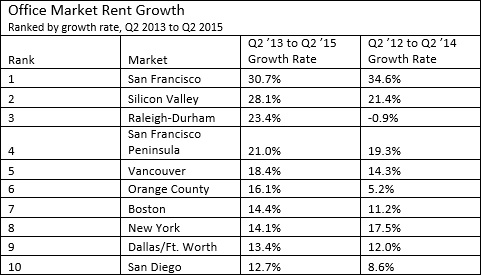

Rent growth across the Tech-Thirty markets display some of the biggest increases in office sectors across North America, with San Francisco and Silicon Valley topping the list with rental growth rates of 30.7 and 28.1 percent from Q2 2013 to Q2 2015, respectively. This growth translated to the two top tech markets posting average office rental rates of $67.99 and $49.20, respectively, in Q2 2015. In that same period, Phoenix saw rental growth rates of 8.3 percent and as of Q2 office lease rates were $22.06. Comparatively, Denver and Austin – two cities Phoenix regularly competes with in site selection bids for tech companies – have seen rental rate growth of 11.8 and 11.4 percent and posted Q2 rental rate averages of $24.15 and $31.33, respectively.

“Metropolitan Phoenix is undergoing major changes. We talk a lot about the diversification of the Phoenix and Arizona economies and reports like this one prove the investments that have been made towards economic expansion are paying off,” said Kevin Calihan, senior vice president with CBRE’s Phoenix office. “The Valley has a growing, young and educated workforce and an office market that’s attractively priced when compared to our competitors.”

Tempe came in as the Valley of the Sun’s hottest tech submarket, registering 18th on the Tech-Thirty list of the top tech submarkets in each market in terms of rent growth and 13th in net absorption. Tech occupiers’ demand for amenity-rich environments and quality office product has caused Tempe rental rates to appreciate when compared to overall market rates. And while current average rental rate in Tempe is $22.08, just two cents over the Valley wide average, premier properties can command rates nearing $40.00.

“Rental rates in Tempe can fluctuate depending on a number of factors, including location within the submarket,” said Calihan. “Rates in the more suburban parts of Tempe typically fall in the mid to upper $20.00 range, while rates in downtown Tempe are about $10.00 higher.”

In submarkets like Tempe, the lack of available space in blocks of 25,000 sq. ft. or more in buildings proximate to walkable amenities has developers jockeying to initiate new projects to chase this demand. Those developers that are successful in getting projects launched are being met with significant interest from tenants. Parkway Properties’ Hayden Ferry Lakeside is a prime example. The project’s third building broke ground in May 2014, and as it nears completion the property is already 85 percent pre-leased.

“There is definitely an urban migration happening in a variety of submarkets across the Valley,” said Calihan. “Companies, particularly tech companies, recognize employees want to work in amenity rich environments with access to public transit, multifamily housing options, and vibrant recreation and nightlife – submarkets like Tempe with projects like Hayden Ferry check all of those boxes.”

Source: U.S. Bureau of Labor Statistics, Statistics Canada and CBRE Research, July 2015.

The high-tech software/services industry has created 730,000 new jobs since 2009 and was the leading driver of U.S. office market demand, accounting for 20 percent of major leasing activity, through Q2 2015. In many leading tech markets, the sector is even more dominant: in Silicon Valley, Austin, San Francisco and Seattle, high-tech companies accounted for 88 percent, 63 percent, 62 percent and 60 percent of major leasing activity through Q2 2015, respectively.

“The high-tech industry is directly supported by consumer demand and a growing number of high-tech integrated businesses, which should keep the industry strong in the years ahead and provide further support for office markets in the Tech-Thirty,” said Colin Yasukochi, director of research and analysis for CBRE. “Commercial real estate investors must be mindful and have realistic expectations about this historically volatile industry underpinning the health of many ‘Tech-Thirty’ office markets.”

About CBRE Group, Inc.

CBRE Group, Inc. (NYSE:CBG), a Fortune 500 and S&P 500 company headquartered in Los Angeles, is the world’s largest commercial real estate services and investment firm (in terms of 2014 revenue). The Company has more than 52,000 employees (excluding affiliates), and serves real estate owners, investors and occupiers through more than 370 offices (excluding affiliates) worldwide. CBRE offers strategic advice and execution for property sales and leasing; corporate services; property, facilities and project management; mortgage banking; appraisal and valuation; development services; investment management; and research and consulting. Please visit our website at www.cbre.com.